A Guide to the Benefits of Investing in a Small Business CRM Platform

CRM is an acronym for customer relationship management. It started out with Rolodexes and sticky notes before the proliferation of the digital marketplace morphed it into something far superior. While some businesses still document customer information the old-fashioned way, it is not extremely effective or efficient. Not only does customer relationship management software save time and money […]

The Best Financing Options for your Healthcare Business

The healthcare industry and the financing industry undergo constant changes. New options for financing are constantly emerging and this can make choosing the best financial option for your healthcare business a little confusing. What makes the healthcare industry special is the constant cash flow that it faces, and the immediate and constant financing it may […]

Strategic Advertising Company Leverages Short-Term Funding to Address Receivables Gap

For more than 30 years, Good Advertising has worked with clients of all sizes in Memphis and around the world. Owner Ellen Isaacman and her team take pride in creating innovative designs and insightful marketing strategies. Like many small businesses which depend on accounts receivables, they found themselves faced with navigating uneven cash flow despite […]

Ask the Experts: Advice for Small Business Owners Considering a Renovation

If your business has reached its maximum capacity within its current design and infrastructure, or if you are seeing revenue disappear due to market pressures, it may be time for you to invest in a renovation. While the long term value may be clear, the near term challenges of capital, planning, and the renovation itself […]

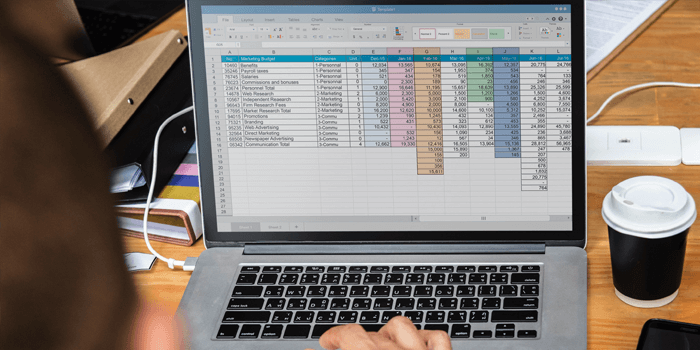

Managing Your Business’ Capital Investment Through Stage-Gating

Stage-gating helps companies determine what investments to make and if they are in line with the company’s strategy. Capital investment through a gated model helps ensure proper capital allocation and portfolio alignment with the company’s brand message. Managers should strictly implement these gates, so they can manage capital spending properly while mitigating risk. Utilizing these predetermined benchmarks […]

Honoring Our Veterans – Garrett Ortega | Reliant Funding

Veteran’s Day is the one day set aside to honor those who have served and continue to serve our nation. It’s also an excellent opportunity to teach civilians about the sacrifice service members have made and also to acknowledge them in the workplace. To show our appreciation in addition to our 2018 Veterans Day offer, […]

How Changes in Transportation Expenses and Regulations Impact Your Business

Due to the Tax Cuts and Jobs Act (TCJA), many common transportation expenses are no longer deductible to employers. Specifically, moving and unreimbursed travel-related business expenses were not treated as taxable income under pre-tax law changes. Businesses need to adapt to these changes, so they can appropriately adjust their budgets. There are steps that you can take […]

Small Business Saturday Insights 2018

The small business community is a strong and important part of the US economy. We wanted to highlight the best statistics from Small Businesses to celebrate Small Business Saturday. Read the infographic to know; who is making purchases, average amount spent, what shoppers buy, how to maximize your participation and more! *Transcription below* Small Business […]

Reliant Funding Supports Small Business Saturday

As a financial partner of the small businesses we work with every day, we are proud to support this year’s Small Business Saturday on November 24th, 2018. According to the Small Business Administration 64% of net new private-sector jobs are generated from small businesses across the country. Help us in honoring Small Business Saturday by frequenting […]