Running a seamless small business requires a continuous flow of cash and its accurate accounting. Accounting plays a huge part in business, and it affects the profitability of your organization directly.

If you are a small business owner and if you are thinking that your accounting process need not be as good as the Fortune 500 companies, then you are wrong. In today’s fast-paced business environment, accounting is not just about debits and credits. It gives insights on your business that can be critical for its future decisions such as:

- Finding the worth of each customer and the losses that might have incurred by spending more on pursuing the customers who don’t add value to the business.

- Tracking and segregating expenses (increase/decrease) that come with the change of vendors, sellers, business processes, etc. depending on what works and what doesn’t for the business.

- Understanding the business’s financial position and if needed look for a small term funding options that will be apt for the business.

- Providing evidence in complying with law including departments like income tax, sales tax, customs and excise.

A study in 2018 found that 95% of the small finance business owners think their books are accurate while the experts believe otherwise.

Glitches in the financial records are ticking bombs that can blow up on your business overnight. Hence, it is essential to understand the importance of expert accounting, the challenges commonly faced by small businesses and the solutions for them.

Challenges of Accounting

1. Differentiate Personal and Official Accounts

You might be the owner of the business, but mixing up your personal and official accounts is not good for your financial books. Cleaner the financial records, the easier it is to account. If you have your family dinner bills included in your official statements, then chaos is not far away.

Including personal expenses into official records is one of the most common issues found in small businesses that can raise red flags among tax auditors, potential business partners, and their likes

2. Unforeseen Expenses

Small businesses bring unexpected expenses from directions you would have never anticipated. Insurance, professional fees, credit card fees, etc. are some of the general surprise expenses that small businesses face. Reduce the number of times you run into unforeseen expenses by creating meticulous budgets.

Cash flow can be tight on certain days and receiving a bill is the last thing you want at that time. Hence, ensure your accountant and you have left no loopholes in your budget plans.

3. Differences in Mode of Payment

Your accountant prefers accrual based payment, but your client prefers cash? There is always a difference in the preferred payment methods between accountants, business owners, and the clients and bringing in too many payment methods can create chaos.

Accrual-based payment is suitable for larger B2B businesses while owners of smaller B2C businesses prefer cash payments. It’s for you to decide which payment method suits your business and also enables seamless accounting.

4. Tax Returns Challenges

Businesses shut down after IRS and CRA penalties proving that tax filing can not be taken lightly. Almost 70% of the small business owners claim that they have filed their taxes accurately yet one-third of them think they are overpaying their taxes. Tax filing is not an easy task, and it can be stressful for business owners who are not great with financials. It is critical for you to have a small business accountant who takes care of your tax filing and also a tax software that can improve your accuracy.

5. Payroll Misses

Payroll time is the most dreaded time of the month for accountants and small business owners. Payrolls can be tricky and painstaking if you do not have these points in order:

- A defined pay period.

- A verified compensation and employee benefit plan.

- Differentiation of a full-time employee and a contract employee.

Incorrect payments, improper records, exclusion of compensation or gifts, Form W-2 errors, etc are some of the common payrolls misses that every small business faces. Missing payrolls or creating payrolls with errors is not good for the business or its employees.

Challenges of Invoicing

Getting paid is the best part of any work be it working for an organization or owning a business. Sending out invoices on time and getting it cleared are important tasks that you should concentrate on.

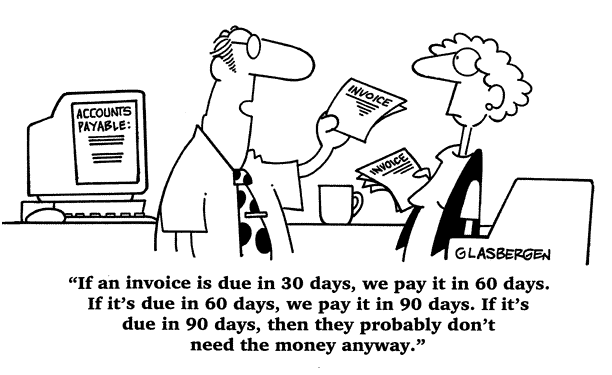

Invoicing is a massive part of accounting that has challenges of its own. These challenges are even more for small businesses as you usually have only one accountant for all your accounting processes and this might affect the invoice’s accuracy and timeliness. But, the invoicing challenges have to be overcome quickly as small businesses thrive on immediate cash flow from their clients.

1. On-time Invoice Issuance

We all plan the invoices to go out on the assigned dates. But, is it possible to maintain this timeline in a small business environment where you and your accountant are swamped with work throughout the month? It is important to find tools and cloud computing software that can help you to prepare invoices and quickly send them out easily.

2. Overdue Invoice Follow-up

If you are the owner of a small business, you will understand how frustrating it is not to get cash in the expected time and to follow up on the invoice overdue. Many small businesses incur losses because of overdue invoices that have been missed or the business has given up after a number of follow-ups.

Keeping track of all your invoices and reminders for overdue is essential for your business but make sure the invoice amount is worth the effort.

3. Splitting payment across invoices

Payback time can be tricky. Clients may settle all your invoices at one go, and it will not be easy for the accountants to match the payments to the invoices. To avoid confusion, you can ask your clients to add invoice numbers to every payment they make. This simple exercise can help you find out which invoices have been cleared and which have not been.

4. Invoicing Accuracy

In accounting, accuracy is a factor that should be put on the pedestal. Carelessness can lead you to huge problems and losses. It should be made sure that all the invoices sent out are double checked and approved by you and your accountant. Inaccurate invoices might not be received well by your clients or vendors, and this might affect the business in the long term.

Accounting Best Practices

Challenges are always a part of the business. Accounting challenges might look like it impacts the business a bit more than the others because of the direct involvement of inflow and outflow of cash. On-point accounting is essential for you to avoid the dreaded chunks of last-minute work involved due to inefficient accounting from the very beginning.

There are some recommended best practices for accounting especially for small businesses that might be helpful for you.

- Understand your business: Accounting tips for small business might be a little too general for you to implement. It is essential for you to understand your business, the sector it belongs to and other unique factors such as seasonality and then make your accounting decisions. The financial and accounting ideas for seasonal business might not work for an all-year business and similarly what works for you might not for another business in your own vertical. Hence a deep understanding of your business is a mandate.

- Invest in the Best to get the Best: Your business might be small, and you might have enough financial knowledge to take care of your accounting. But, understand that your business needs the same accounting practices as that of multinational organisations. Invest in a specialized accountant and accounting software to see your accounting process vastly improve. If you are trying to curb your expenses by not hiring a professional accountant, then it is a huge mistake as you might be losing more money by not accounting correctly. If you have a money crunch, then consider taking a small business line of credit that can enable you to solve your cash problems.

- Keep a Close Tab on your Receivables: There might be a lot of invoices sent out to many of your vendors and clients at different times of the month or year. Keeping a detailed track of these invoices are as important as sending them out. Take the help of accounting software like QuickBooks to make this process easier for your accountant. Running a small business is filled with tough choices and making your clients pay come what may is one of them. There is a risk of spoiling the relationship with them, but at the end of the day, it is essential to do what is best for your business.

- Collect applicable taxes during payment: Include tax amounts during the time of invoicing to reduce the chances for errors. Longer the time between transaction and payment, the more the opportunity for discrepancies. Collecting tax during payment will also ensure, you are not responsible for a lump tax amount at the end of the year. You won’t have to go through tax penalties for a delayed tax settlement.

- Keep Inventory Record: If your small business involves a lot of inventory, then the records for the same should be maintained meticulously. Detailed records of your inventory help in:

- Maintaining clear accounts that can be recalled even after years

- To avoid theft and misplacement of stock items

- To prevent mismanagement of stock that causes loss to the business.

- Focus on Monthly Profit sheet: We all know small businesses operate on quarterly, half-yearly or annual basis when it comes to checking their profitability. But, to keep track of your accounting process, check your monthly profits too. This will help you to get a deeper insight on your day to day processes that affect your profitability.

Planning and maintaining the accounts for a small business can get complicated. A small mistake in data gathering, calculation or invoicing can impact your business at many levels. Like many other challenges, accounting and invoicing challenges can also be overcome with diligent planning and excellent execution.

Connecting with business owners in your field, attending seminars, workshops and actively participating in forums can help in understanding the challenges faced by your counterparts.

We always believe that prevention is better than cure, so don’t wait for accounting challenges to happen to your business. Act before it gets to you.

Creating a foolproof accounting and invoicing process is easier said than done. There might be many glitches on the way which might be even unique for your own business. Don’t lose your confidence when you come across such challenges or mistakes. Learn from the mistakes, seek the help of your mentors in the field and continuously modify your accounting methods.

Your business might be small and might not have more than ten employees now. But, setting the highest standard for your accounting affairs is vital to make it easy for you during expansion. There is one problem less when you are opening up your business for more people, and your accounting process is proficient enough to handle all the extra load.

As a small business, you might feel you can get away with bookkeeping on your own, but the tax filing or book closure can bring with it last-minute surprises. That is the time you will know how much information is still required to make your accounts close to perfect. Hence, we suggest that you start early, understand your strengths and weaknesses in the accounting and budgeting part of your business.

Professional help with accounting and invoicing nuances collected from research can help your business go a long way without any pitfalls.